Top 50 Accounts Receivable Interview Questions and Answers

After you sign up, we’ll reach out to guide you through the first steps of setting up your TestGorilla account. If you have any further questions, you can contact our support team via email, chat or call. accounting software for small business of 2022 This is a great way to leave a positive and lasting brand impression on your candidates. The Accounts Receivable test will be included in a PDF report along with the other tests from your assessment.

Strategies for Reducing DSO and Improving Cash Flow

By evaluating metrics such as current and quick ratios, debt-to-equity, and asset turnover, one can gauge operational efficiency and potential financial risks. Understanding balance sheet dynamics is essential for making informed investment decisions and assessing a company’s long-term financial health. C. Bad debt expense is recorded with a debit or a credit depending on the method used.

What is the Accounting Receivable Test

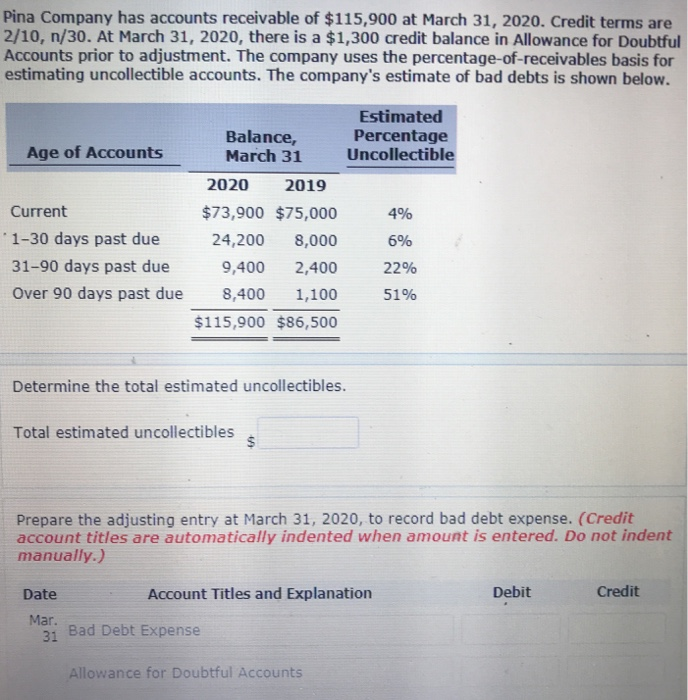

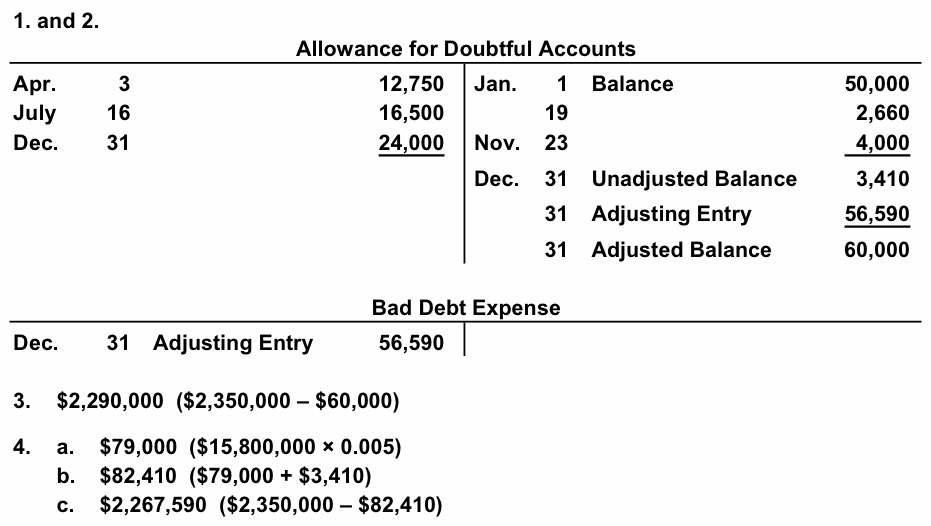

The accounts receivable is always increased and decreased for the entire amount. Bad debt has to be $28,000 for the ending balance of the allowance account to equal 29,000 given. Multiply each category balance by the % estimated uncollectible to get the total the company estimates will not be collected.

What job roles can you hire with our accounts receivable skills test?

Before being published, each test is peer-reviewed by another expert, then calibrated using hundreds of test takers with relevant experience in the subject. Accounts receivable specialists, accountants, auditors, payroll clerks, credit counselors, finance managers, and other roles that require a good grasp of accounts receivable. If you wish to take an accounting quiz please do so by first choosing a quiz from the Popular Quiz list below. Note that there is no time limit to answer the questions, and you can have as many goes at answering each question as you like.

Purpose and Structure of the Balance Sheet

You can take your time using our step-by-step guide, or take a timed test to simulate the actual exam. An organization estimates that $20,000 from its $500,000 of accounts receivable will become uncollectible. There is a credit balance of $8,000 in its Allowance for Doubtful Accounts. A __________ to the Allowance for Doubtful Accounts will be included in the adjusting entry.

Are accounts receivable important for small businesses?

The accounts receivable clerk test is crafted for recruiters to identify potential candidates by evaluating their job readiness. They are also in charge of managing any issues or discrepancies related to payments. It is an account receivable clerk’s responsibility to address customers promptly when they have any questions or concerns about an invoice. An accounts receivable test is designed to evaluate a candidate’s skills in recording transactions, finding missing information, managing accounts receivable, and many more.

- Let’s look at these qualities and how to showcase them during your interview.

- Analyze the methods used to assess liquidity, solvency, and financial leverage through ratios such as the current ratio, quick ratio, and debt-to-equity ratio.

- The main reason deferred revenue is a liability is that a customer has paid the enterprise, but the enterprise has not yet fulfilled their obligation to the customer.

- The five tips in this section will make the interview process easier and help you enhance the candidate experience.

- Suppose Company B has total liabilities of 1 million dollar and shareholders’ equity of 500,000 dollars, resulting in a debt-to-equity ratio of 2.0.

- In this case, you should note what they learned from this error and whether they adopted any proactive methods to prevent such errors in the future, such as working on their attention to detail skills.

If Company C has annual revenue of $3 million and average total assets of 1 dollar million, its asset turnover ratio would be 3.0, meaning it generates 3 dollars for every 1 dollar of assets. This efficiency might reflect effective management and high demand for the company’s products. However, if industry standards show an asset turnover ratio of 4.0, Company C may need to enhance operational efficiency or increase sales to match industry performance. When analyzing a company’s liquidity, the current ratio and quick ratio are essential indicators. If the company’s inventory is 100,000 dollars, the , showing the company’s ability to meet obligations without depending heavily on inventory. This analysis is crucial in assessing short-term financial stability, especially in industries with fluctuating demand cycles.

Be prepared for the next steps in the hiring process, such as second interviews or assessment tests. Accounts receivable refers to the payments that a company is owed from their clients. JobTestPrep’s Accounts Receivable PrepPack™ is relevant only to the USA companies and will prepare you for the accounts receivable test with practice tests and detailed score reports.

Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. If you need a refresher course on this topic you can view our tutorials on the accounts receivables here. Leadership and conflict resolution are invaluable skills for any Accounts Receivable professional.