Rent Expense Explained & Full Example of Straight-Line Rent

One such ratio is the accounts receivable turnover ratio, which measures how efficiently a company collects its receivables. A higher turnover ratio indicates that the company is effective in collecting rent, translating to better cash flow and reduced risk of bad debts. Conversely, a lower ratio may signal collection issues, necessitating a review of credit policies and collection procedures.

Accrued rent revenue journal entry

For instance, if rent is due on the first of the month but not paid until the fifteenth, the receivable is still recorded on the first. This approach provides a more accurate picture of revenue and outstanding obligations. When rent is paid in advance of its due date, prepaid rent is recorded at the time of payment as a credit to cash/accounts payable and a debit to prepaid rent. When the future rent period occurs, the prepaid is relieved to rent expense with a credit to prepaid rent and a debit to rent expense. At transition to ASC 842, the accumulated deferred rent, or accrued rent, for an operating lease is an adjustment to the ROU asset related to the lease.

Management Override of Controls

However, once you receive the rental payment, you decrease the rent receivable account with an $800 credit entry and post a debit entry for the same amount to the company’s cash account. When cash payments in a period were greater than the expense recognized, prepaid rent would be capitalized on the balance sheet with a debit rent receivable journal entry balance. This was considered a prepayment, which is an asset, due to more rent being paid for than rent expense incurred. For an extensive explanation of prepaid rent and other rent accounting topics, see our blog, Prepaid Rent and Other Rent Accounting for ASC 842 Explained (Base, Accrued, Contingent, and Deferred).

Is rent payable a debit or credit?

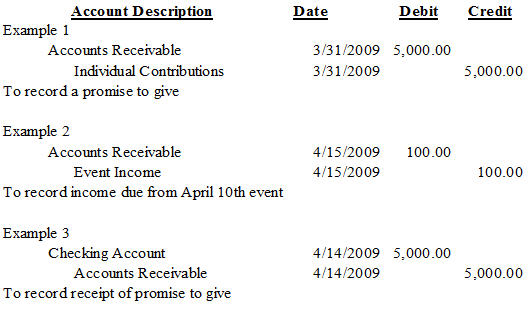

To increase or decrease a rent receivable account balance, it’s always necessary to post journal entries to your company’s general ledger. Since the receivable is an asset to the company, a debit entry will increase its balance, while a credit entry will decrease it. For example, suppose a tenant makes monthly rental payments of $800 at the beginning of each month. On April 1, you will post a debit entry to the rent receivable account for $800 and post a corresponding credit entry to the rental revenue account for the same amount.

- The act of recognizing the expense when the company is obligated to pay for the use of the asset but before payment is made is called accruing the expense.

- This approach ensures that financial statements reflect the true economic activity of the period.

- On the 10th of March, Unreal Corporation received rent 20,000 via a cheque from tenant ABC for one of its property on rent.

In this example, we will assume the lease agreement has met the criteria for an operating lease. Using the stated facts the present value of the lease payments at lease commencement is $970,874 and the ROU asset is calculated to be $980,874, the lease liability plus the $10,000 of IDC. ASC 842 requires the recognition of total rent expense on a straight-line basis over the lease term for leases classified as operating.

Step 4: Calculate the right-of-use asset (with journal entry)

Under ASC 842 any differences between the expense recognized and the actual cash paid are recognized in the lease liability and ROU asset. To record accrued rent receivable, a property owner would make a journal entry at the end of the accounting period debiting the accrued rent receivable account and crediting the rent revenue account. Once the rent is received, the property owner would reverse the receivable and increase the cash account with a corresponding journal entry. Setting up receivable accounts is an integral component of using an accrual method of accounting. In a rental property situation, you earn the rental income on each date that the lease agreement requires the tenant to make payment.

Understanding how to account for rent receivable involves recognizing key components, applying appropriate measurement techniques, and addressing potential impairments. This process not only aids in maintaining transparent records but also supports effective financial management and decision-making. The Rent Receivable account should be reconciled with the tenant’s rent payment to ensure accuracy. QBO only allows you to post invoices and receive payments to the single, default A/R account. QBO allows you to set up an A/R account called ‘Rent Receivable’ but you can’t post invoices or receive payments to it. The only way to get a balance to post to that account is to use a journal entry.

Rent Receivable is an asset (which has a default Debit balance), and Rental Income falls under the revenue group (with Credit balance). With expertise in federal taxation, law and accounting, he has published articles in various online publications. Franco holds a Master of Business Administration in accounting and a Master of Science in taxation from Fordham University. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

For both the legacy and new lease accounting standards, the timing of the rent payment being known is the triggering event. For example, let’s examine a lease agreement that includes a variable rent portion of a percentage of sales over an annual minimum. At the initial measurement and recognition of the lease, the company is unsure if or when the minimum threshold will be exceeded. Therefore the variable portion of the rent payment is not included in the initial calculations, only expensed in the period paid. The periodic lease expense for an operating lease under ASC 842 is the product of the total cash payments due for a lease contract divided by the total number of periods in the lease term.